College Endowment

The College’s Endowment is invested to generate long-term returns in order to support its charitable objectives as follows:

- To deliver a world-class undergraduate education;

- To encourage applications from the most talented students irrespective of social, ethnic or religious background; and

- To promote academic research of the highest quality.

The Endowment is invested on the basis that the College will continue in perpetuity and is invested to generate an investment return.

The Governing Body delegates oversight of the Endowment, through the Finance & General Purposes Committee, to its Investments Committee.

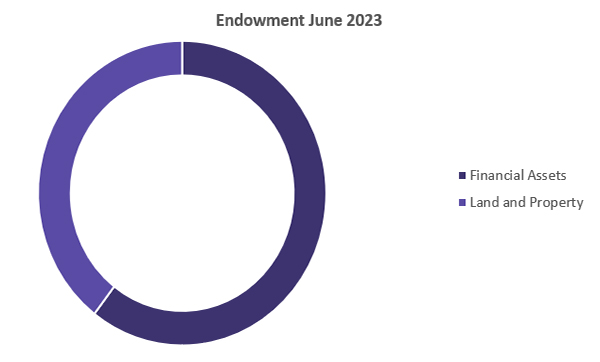

The Endowment comprises two principal portfolios: financial assets and directly owned commercial property, including agricultural land.

Overall Investment Objectives for the Endowment

- To preserve the real capital value of the endowment, after distributions and inflation, over the long term.

- To provide a steady, sustainable and growing cash flow, from both income and capital gains to support the College’s distribution policy.

Distribution Policy and Income Policy

Financial Assets Portfolio - the College has adopted a spending rule based on the average previous 3-year value of the Amalgamated Fund, established in 1956, which comprises of permanent and expendable capital as well as restricted funds. That rate is currently 3.25%.

Land and Property Portfolio - distributes a portion of its annual income after setting aside funds for future repairs and improvements to the property portfolio.

Risk and Diversification

The Governing Body views “risk” in relation to the impact on the College’s ability to maintain its spending rate in real terms over the long term.

Price inflation represents the greatest long term risk to the Endowment. The majority of the Endowment should therefore be invested in asset classes that are expected to offer protection against inflation, accepting exposure to market risk.

Some assets will be illiquid in nature, especially in the property portfolio and others will be owned for their strategic value due to their location to the College e.g. property with specific utility to the College.

Financial Assets Portfolio

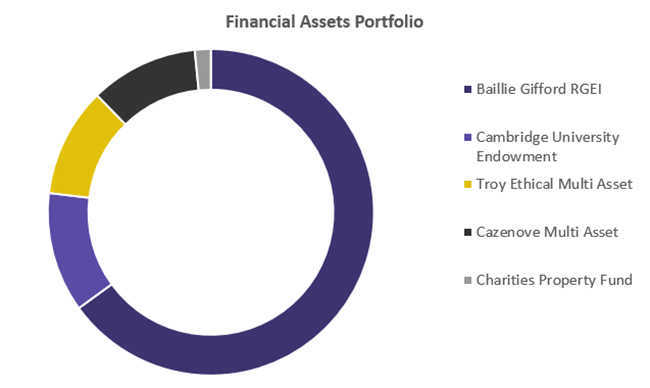

The College’s financial investments are principally invested in funds managed by Baillie Gifford mainly the Baillie Gifford Responsible Global Equity Income Fund.

Land and Property Portfolio

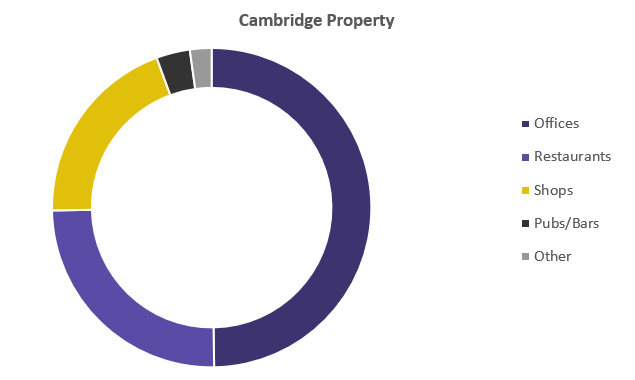

The majority of the College’s property is located adjacent to the main College site and includes the Quayside development.

The portfolio also has non-financial objectives, given its proximity to the College and its long-term strategic value, as follows:

- Provide a strategic resource to the College, to support its current and future activities

- Preserve the architectural and historical legacy of the College

- Maintain the quality of the estate

- Contribute to the Cambridge community

- Improve energy efficiency and environmental impact.

Responsible Investment

The Governing Body believes the investment of the College’s financial capital should align with its core purpose of developing human and intellectual capital.

The Endowment is invested on the basis that social, environmental and governance (“ESG”) considerations are central to the College’s strategic objectives.

The Investments Committee oversees the application of these considerations to the Endowment and the investment managers are required to report, annually, on how responsible investment considerations have influenced their selections of assets and the resulting performance outcome.

The College agrees with the Principles of the UN Compact and works closely with its investment managers to ensure that our responsible investment principles are integrated in the investment processes.

This includes the following areas:

- Environment and climate change

- Human rights

- Labour, Employment rights and discrimination

- Anti-Corruption, corporate conduct and governance

Within the Financial Assets Portfolio the Baillie Gifford Responsible Equity Income, the Cazenove Sustainable multi-asset fund and the Troy Ethical Multi asset Fund specifically exclude:

- Sale or production of oil or gas

- Tar sands and thermal coal

- Gambling and adult entertainment

- Production and sale of tobacco

- Production and sale of alcohol

- Production and sale of armaments

The College holds an investment in the University of Cambridge’s Endowment Fund which plans to reach net-zero by 2038.

The College has a modest long-standing small investment in the Charities Property Fund. The Fund's responsible investment policy is ESG – Charities Property Fund (cpfund.co.uk).